Recently at NotPIM we asked ourselves: how many product listings exist across Europe?

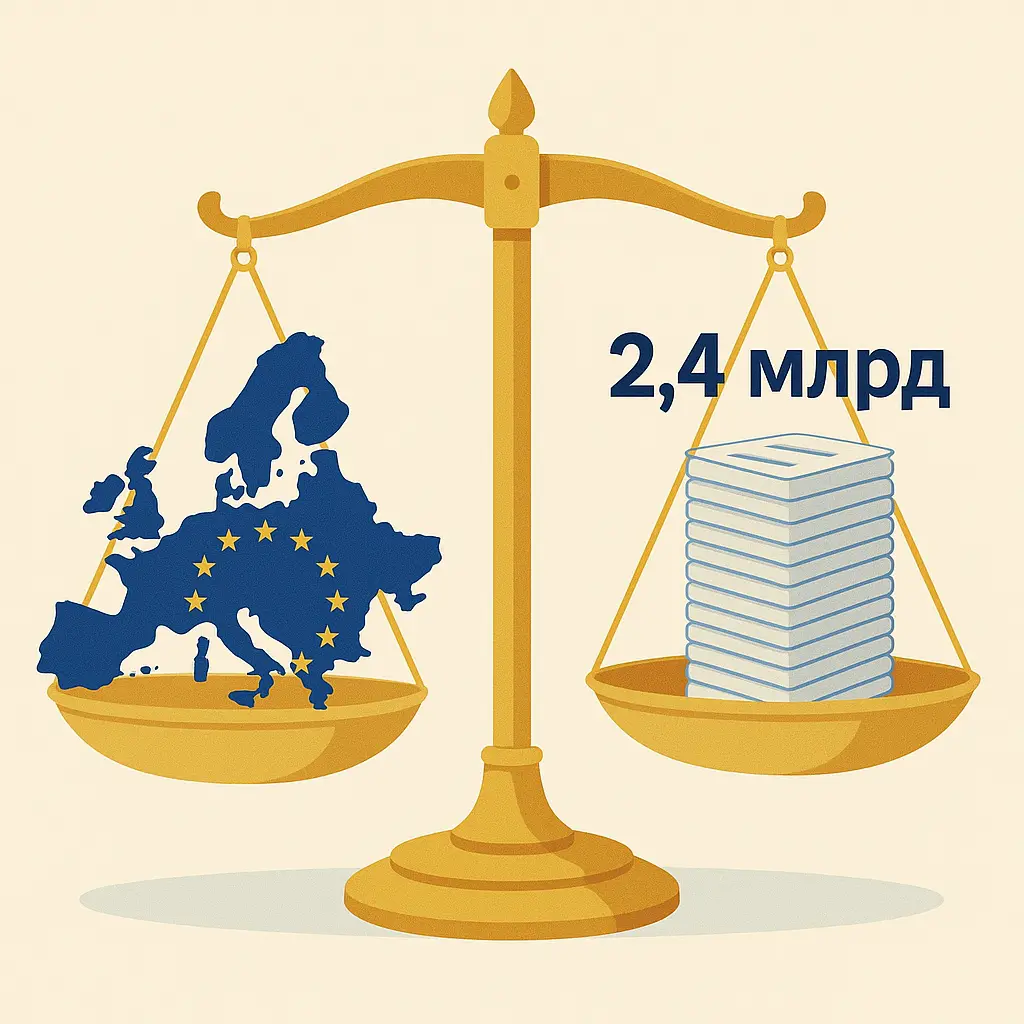

The question seems simple, but the answer is striking: 2,400,000,000.

Yes, that’s right — 2.4 billion product listings. The figure is enormous, almost fantastical. And this is not an academic study, not a consulting report. It’s our own calculation, made to understand the order of scale. We might be off by tens of percent. But the point is the picture itself.

How we calculated

We started from simple assumptions.

There are about 400,000 stores operating in Europe. If we add distributors, logistics companies and other organizations dealing with catalogs, the figure rises to about 480,000 market participants.

The average store assortment is around 5,000 products. Multiply one by the other and we get those same 2.4 billion product listings.

But the number of unique products is far smaller. We estimated around 300 million. The rest are duplicates and overlaps.

What does this mean

This means that each unique product corresponds to an average of 7–8 different listings. They differ in names, descriptions, attributes, formatting.

At NotPIM we see this every day: the same product looks like different entities across various feeds.

— In electronics, one catalog says “6.5” screen,” another says “16.5 cm screen.”

— In fashion, “red” easily turns into “coral” or “wine.”

— In pharma, the opposite: strict standardization where mistakes are too costly.

As a result, the market overall turns out to be incredibly fragmented.

What about standards?

Yes, standards like EAN or GTIN do exist. They answer the question: “are we talking about the same SKU?”

But a standard that would ensure proper transfer of content — descriptions, attributes, photos — essentially does not exist. Each supplier creates their own XML or CSV, each store adapts them as they can. And this turns the market into chaos of formats and incompatible data.

This is exactly where the main pain of e-commerce begins, and what we at NotPIM deal with every day.

Chaos and counterfeit

Content chaos also creates space for counterfeit.

We see “one-day brands” appearing on the market: they release dozens of products, copying the look and description of an existing brand, change only the name — and disappear.

In catalogs, such listings are almost indistinguishable from the original.

If the market had unified data transfer standards and matching algorithms, it would be possible to automatically flag: “this product looks suspiciously similar to another brand.” This wouldn’t ban counterfeits, but it would provide a tool for control.

Why it matters for everyone

- For retailers — less manual work and fewer errors.

- For suppliers — confidence their content reaches partners in its original form.

- For brands — protection against copies and counterfeits.

- For customers — trust in the catalog and in the market itself.

At NotPIM we see our mission as helping the market move toward this future.

A bit of sci-fi

Imagine a market where every product listing is transferred in a perfectly clean form, without distortion.

Where the customer is sure they see the original.

Where brands compete only on price, quality, and service — not against shadows of their own counterfeits.

Today this sounds like science fiction. But this is exactly where the market is heading.

The mission of NotPIM

We don’t claim to have calculated perfectly. Maybe it’s not 2.4 billion listings but slightly more or less. Maybe not 300 million unique products but 250 or 350.

But the order of magnitude is obvious: the market is massively fragmented.

This is exactly why at NotPIM we are building a platform that helps to unify, enrich, and protect product content.

We want the figure 2,400,000,000 to stop meaning chaos — and start meaning a manageable system.